Why Are The Road Tax For EVs In Malaysia So Expensive?

How is it that some gas-guzzling cars pay less in road tax than its eco-friendly EV alternative?

Coming fresh off the imminent arrival announcement of the BMW iX locally, there has been quite a lot of chatter in regards to how this all-electric SUV is actually a bit of a bargain in Malaysia. And it is really not that hard to see why it is to be the case too, as this latest futuristic eco-friendly offering by the Bavarian marque over here arrives fresh from Germany with a price that is nearly the same as it’s similarly sized X5 PHEV sibling.

Then again though, this all-new iX could have actually been that much more financially lucrative for those who can afford to stump up the RM 420,000++ asking price commanded by one of these all-electric SUVs. That is because this EV has a surprisingly high annual road tax of RM 3,063, which works out to be just a little bit under double of what it would cost to tax the aforementioned electrified X5, that comes with a 3.0-litre straight-six under its hood.

Perhaps more surprisingly too is the fact that the high road tax incurred with the iX is not exclusive to this all-electric German SUV, with most EVs in Malaysia in fact being subjected to even more astronomical prices for them to be legally driven on the public roads over here. The road tax Porsche Taycan Turbo S locally for instance costs a hefty RM 12,094 every year, while Malaysians with a dream of owning a lightning-fast Tesla Model S Plaid will be starring down the barrel of an annual road tax bill that totals RM 17,862.

Even for those who decide in opting for a more humble set of eco-friendly wheels meanwhile will also have to fork out a fair chunk of change every year to the JPJ, with even the humble Nissan Leaf’s RM 374 annual road tax rate being equivalent to that of a 2.0-litre car. Though it is nevertheless worth just noting that all these figures stated here have not included the 50% reduction in road tax that was previously offered on EVs since 2019, as there has been some questions on whether this scheme is still ongoing or not.

So there is therefore really two main questions that are warranted to be asked here: Why are the road tax on EVs so expensive in Malaysia, and is it really justified in taxing these electric vehicles at such a high rate? With the latter being particularly noteworthy when considering that the local adoption of these eco-friendly cars over here is severely lacking at the moment, even when compared to our immediate geographical neighbours.

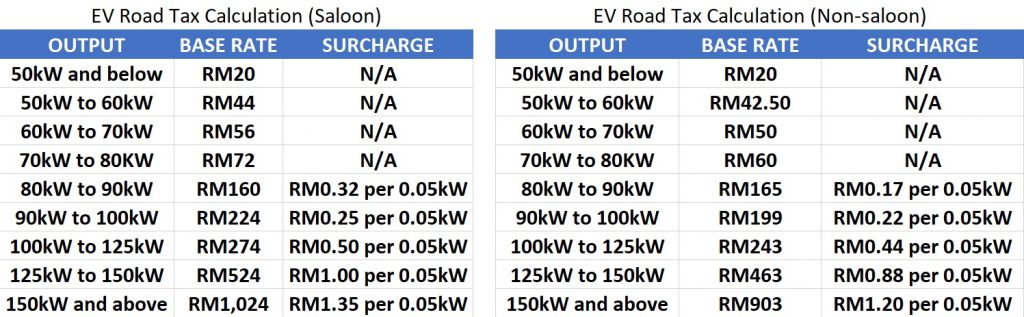

Now expectedly, the first question on the face of it is rather simpler to answer than the second, as the road tax rates on EVs is basically calculated based on the scaled brackets previously established by the JPJ. Brackets which are determined based on the total power output of the drive motor(s), with the full breakdown of these scales (for both saloon and non-saloon cars) being listed in the table down below.

Touching on this EV road tax table above however does bring about two further supplementary questions that does merit some further discussion too. The first of which being whether or not this is indeed a sensible way in taxing EVs, while the follow up relates to whether the brackets here are realistic or not in the way they stand today.

Starting first then with the debate on using total power output as a taxation calculation measure, it may be surprising to hear that there is actually some merit in using this method to determine the rate of road tax on EVs, and that essentially boils down to the fact that it is really the *only* sensible technical means of distinguishing these eco-friendly vehicles. To add to that too, it does make more than a modicum of sense for the more powerful (and typically more expensive) electric cars to be paying a higher premium on their road tax in comparison to the lowlier powered mass-market zero-emissions counterparts.

What doesn’t really make as much sense though is with the brackets and rates itself that has been set by the JPJ on EVs, as even the most compact of all-electric urban runabouts on the (global) market today with their sole 100 kW motor — like the Honda e or Peugeot e-208 for instance — will have an annual road tax of RM 274. A figure that will seem to be more than a bit steep, when put into the perspective that a slightly more powerful 110 kW (150 PS) VW Golf with its 1.4-litre turbocharged four-cylinder piston engine will only cost a measly RM 70 to tax every year over here.

This therefore neatly transitions to the subject on whether or not EVs should incur an annual road tax or not, particularly in the early stages of EV adoption that Malaysia seems to be (finally) undergoing right now. Countries like Norway and the UK are after all still exempting all fully-electric vehicles from road tax in order to further incentivise the rapid adoption of these zero-emissions cars in their respective nations, and there has also been talk of such a proposal coming into action over here in recent times too.

Much like most proposals over here however, it is pretty much still all talk and no action thus far. There are also some reasonably valid arguments against this plan too, with the biggest one being that that this could technically be seen as another tax break that only benefits the rich, especially when seeing that only the well-to-do locally will be able to afford an EV over here at this point in time.

Whatever one’s views on that rather touchy topic though, there is perhaps common consensus when it comes to perhaps revisiting the road tax brackets for EVs to at least make it somewhat comparable to their equivalently powerful naturally-aspirated fuel-drinking counterparts. And while the government is at it, it is perhaps worth also considering looking into offering further financial incentives into improving the charging infrastructure over here, or even attracting automakers to assemble their all-electric offerings locally?