Toyota Reports Record Quarterly Profits Of RM 38.6 Billion

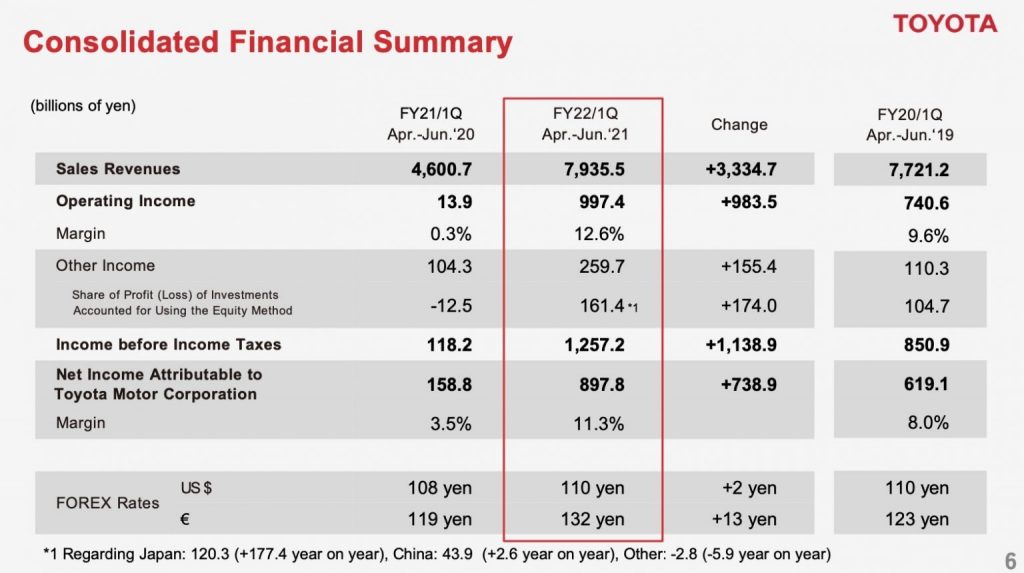

This nearly ¥1 trillion figure is 5 times more than Toyota had made in the same time last year.

With nearly every other automaker proudly announcing that sales have been on the up and up since the slump experienced last year, it perhaps wouldn’t come as a shock for the world’s largest automaker to do the same. Though even Toyota themselves were probably pleasantly surprised at the scale of its recent successes, with the Japanese auto giant recently posting its best-ever quarterly operating profits in its 88-year history.

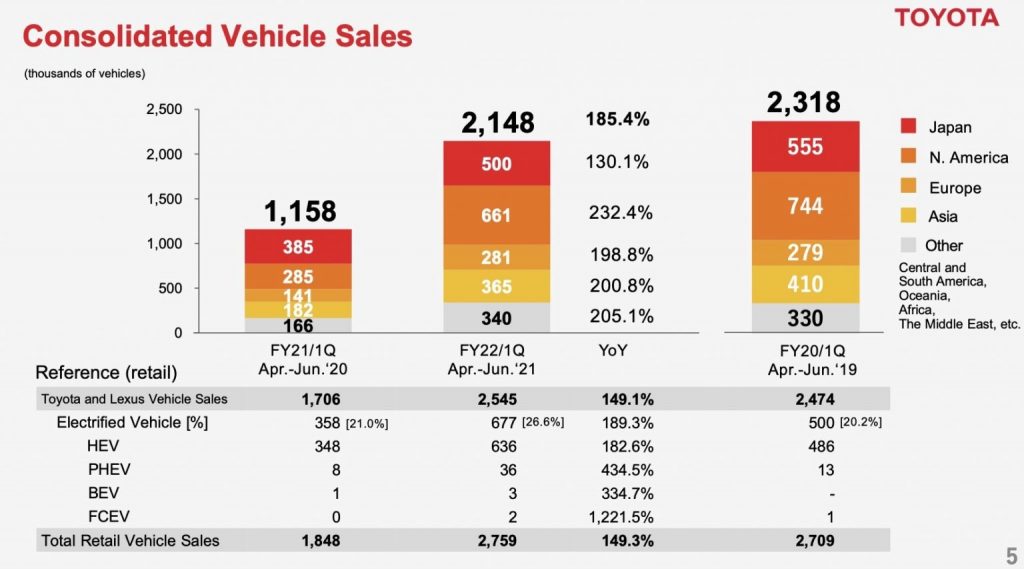

Raking in an astonishing $9.15 billion (RM 38.6 billion) in profit from between the months of April and June of 2021, this huge sum is about 5 times what Toyota had managed to pocket in the same pandemic-riddled period of last year. In terms of vehicles sold meanwhile, the 5 million units delivered globally by the automaker in the first half of 2021 marked a reasonable increase of around 32.7% from the same time in 2020.

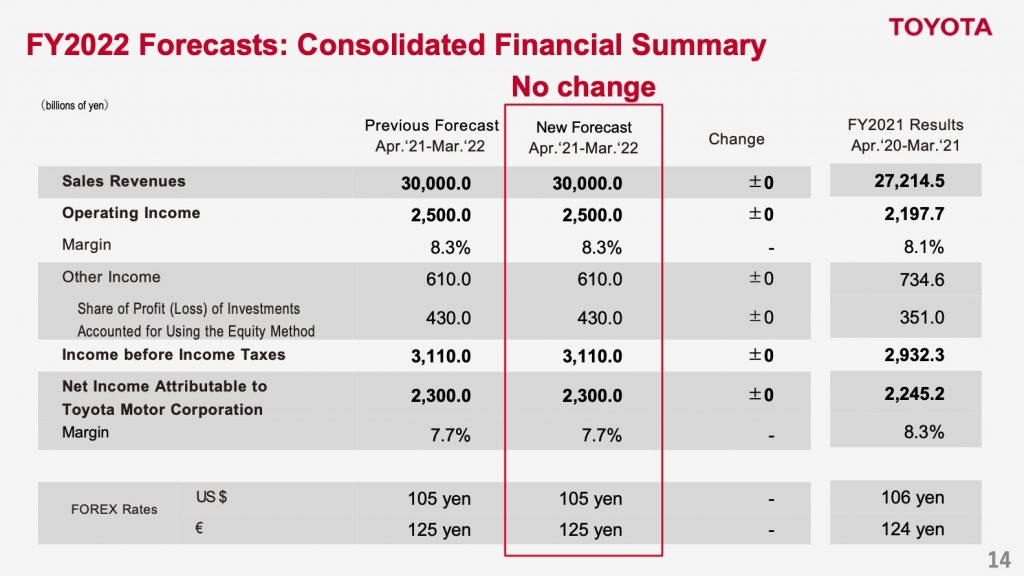

Despite all this good news from Toyota however, its share price has rather interestingly suffered a small dip when the financial results was first made public. And that is because amid all these positive signs of recovery, the Japanese auto giant however has thus far been reluctant to revise their their net profit forecast for the rest of the financial year ending next march.

There are though several good reasons as to why Toyota is currently playing it safe with its forecasts, with the major one being the ongoing semiconductor shortage envisioned to more greatly impact its auto production in the coming months. An uncertain situation due to the spread of the coronavirus in emerging economies, as well as a forecasted rise in the prices of raw materials have also been cited to be behind the firm’s decision in maintaining a conservative profit outlook for the near future.

Now thanks to its business continuity plan developed in the wake of the Fukushima earthquake in 2011 that required suppliers to stockpile anywhere from two to six months’ worth of chips, the Japanese automaker has not been hit that badly yet from this crisis which has since crippled many of its other competitors. Seeing though as this semiconductor shortage is likely to be a thorn in the industry for a long time coming, it is not outside the realm of possibility that even these stockpiles will not be sufficient to sustain Toyota’s current levels of production in the latter half of this year.

Focusing on more immediate problems for Toyota on the other hand, its global production capacity has also currently been greatly hampered due to the Delta variant outbreak in South East Asia. Its manufacturing plants in Thailand and Malaysia for instance has been forced to close in order to comply with the lockdown restrictions placed by their respective governments, with its Japanese plants too having to lay idle while waiting for parts to arrive from these countries.

“In the first quarter, we have seen the results of our improvement activities despite the severe business environment,” Toyota said in a statement recently. “We will continue these activities in the future, but the situation is still unpredictable due to the expansion of COVID-19 in emerging countries, the semiconductor shortage and soaring material prices.”