Many Car Owners Do Not Have Flood Damage Insurance

With flood damage cars rising as the rain persists, you need to look not this protection.

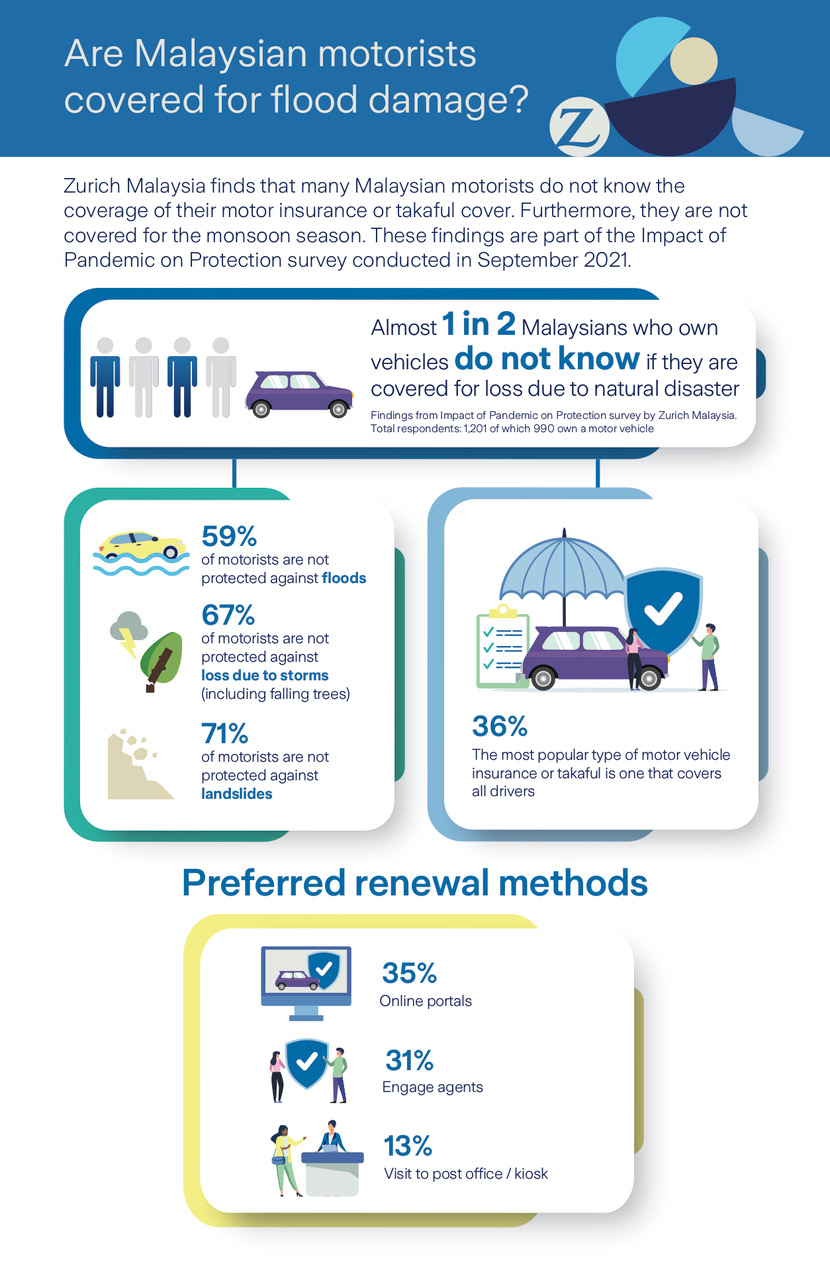

Car insurance provider Zurich Malaysia recently reported that 59 percent of Malaysian motorists still do not have adequate protection against flood damage, as one of the findings under its Impact of Pandemic on Protection survey.

In August this year, dozens of vehicles were damaged in severe floods in the northern state of Kedah and most of the owners did not have any form of insurance coverage for flood damage.

Car drivers (like this BMW driver pictured above who was caught in a recent flood in PJ) are unaware if they are or not prepared and think they are not affected.

Car owners affected, like mentioned above have no choice but to scrap their cars or try and fix them with their savings.

This is a cause for concern as Malaysia regularly experiences monsoon seasons, such as the current Northeast Monsoon season from November until March next year. The Malaysian Meteorological Department has warned certain states are expected to have higher than average rainfall of between 450 mm and 1,000 mm in November and December.

In addition to flooding, landslides and falling trees are potential perils that Malaysian motorists are not prepared for. Only one in three active motorists (34 percent) reported having coverage for storms including falling trees, and only 29 percent are covered for landslides.

The survey also found that in terms of renewing their motor vehicle insurance and takaful, Malaysians still engage agents to do so. Out of 990 respondents who own a motor vehicle, 38 percent chose to go through an agent despite the availability of online portals.

However, online portals were the most preferred method with 43 percent of the motorists utilizing them. This shows the importance of digital tools in today’s market. Meanwhile, 16 percent of Malaysians opted to visit a physical kiosk or post office themselves to renew their insurance personally.

In terms of motor insurance and takaful coverage, a noteworthy trend is that most Malaysians prefer plans that cover all drivers (36 percent) instead of just named drivers in the policy (34 percent). This is particularly useful if the car owner is in the vehicle but not behind the wheel, such as taking turns on a long interstate journey.

Some Malaysians may only sign up for protection solely to have a valid motor insurance or takaful as mandated to be able to renew their road tax and drive. This is evidenced by 47 percent of vehicle owner respondents reporting they are unsure of their coverage content.

Conducted in late September 2021, the survey engaged 1,201 Malaysians from all states, of which 990 are vehicle owners. It is an effort by Zurich Malaysia to understand the local consumer landscape and design protection plans that best suit customers’ lifestyle needs and create a brighter future together.