Touch ’n Go GO+ Investment Service Launched In Malaysia

This new GO+ low-risk micro-investment feature is available now in the Touch ’n Go eWallet.

Touch ’n Go has recently launched its much-hyped GO+ feature on its eWallet application. The first of its kind in Malaysia, it is described to be a ‘financially inclusive investment product that allows TnG eWallet users and all Malaysians to gain access to low risk money market investments for as low as RM10’.

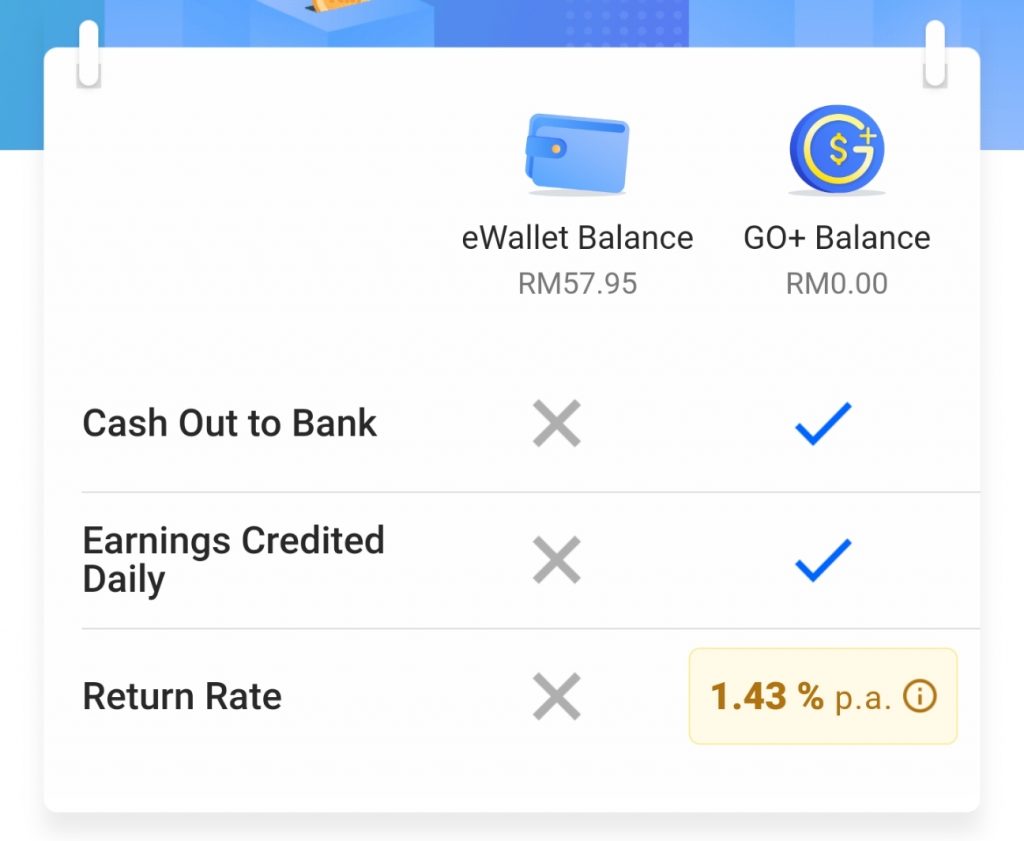

To those who are not fluent in financial jargon, GO+ could be thought of as akin to as a bank account whereby interest can be gained from the money deposited into the dedicated account within the Touch ’n Go eWallet. What more is that the with its ‘cash-out’ feature, funds can be moved seamlessly between the user’s eWallet and designated bank account, as well as to be used for all eWallet payments.

Speaking more about the investment side of things, while the return rate for GO+ is not as high (1.43% per annum at time of writing) as say a fixed deposit, what Touch ’n Go is intending to do with this new feature is focus more on liquidity and convenience. Part the reason why therefore that the returns will be credited daily instead of monthly, as well as the low barrier to entry of just RM 10.

The first eWallet provider to obtain approval to operate as a ‘Recognised Market Operator’ by the Securities Commission of Malaysia, Touch ’n Go is able to directly distribute capital market products, including money market unit trust funds, through its eWallet platform. All without having to be directed to a third-party application.

As for the GO+ feature itself, it is anchored by anchored on the Principal e-Cash Fund, a money market fund managed by Principal Asset Management, and the funds will be will be invested in a combination of cash (at bank), placement of deposits, money market instruments and/or debt instruments in MYR. More of the technical details can be found in the press release below.

What is more pertinent (and easier to understand) perhaps is that the GO+ feature is available now to all Touch ‘n Go eWallet users who are Malaysian citizens above 18 years of age. To sign up for this investment feature, simply fill up the form after tapping on the GO+ logo within the eWallet app and make your first cash in that is a minimum of RM 10.

Other things to note about GO+ is that the maximum amount that is currently able to be deposited within the investment product is RM 9,500. It is also not a Shariah-compliant fund, though a Shariah-compliant version is currently in the works.

Summing up GO+ in a sentence, it is basically a neat little feature to have earning you a little bit of money instead of having the Touch ’n Go eWallet balance sitting there not doing anything. It just remains to be seen then as to whether any other e-wallet services will be offering similar financial services in the future.

PRESS RELEASE: Touch ‘n Go (“TNG”) Group today announced the launch of GO+, a financially inclusive investment product that allows Touch ‘n Go eWallet users and all Malaysians to gain access to low risk money market investments for as low as RM10.

GO+ enables an easy and convenient method for Touch ‘n Go eWallet users to earn returns on their GO+ balance. The returns will be credited daily. In addition to this, GO+ will also carry a ‘cash-out’ feature that will allow movement of funds seamlessly between the user’s eWallet and designated bank account. In order to add greater usability, GO+ balances can also be used for all eWallet payments use cases.

“The launch of GO+ is the first step as we move into the area of digital financial services. It was designed to address core customer pain points, promote financial inclusion and emphasise the use of data and technology to deliver higher value products to our users. We’re extremely pleased to have been able to bring this novel product to the market, and at the same time continue our evolution and journey into financial services,” said Effendy Shahul Hamid, Group Chief Executive Officer, TNG Group.

“New norms in light of Covid-19 have seen a boost to everything digital, and we’re fortunate to have been able to be agile and pivot to bring GO+ to the market ahead of time. Our thanks go out to the regulators, specifically Bank Negara Malaysia and the Securities Commission of Malaysia for their efforts in facilitating this innovative product offer,” added Effendy.

The GO+ product is anchored on the Principal e-Cash Fund, a money market fund managed by Principal Asset Management (“Principal”), a leading ASEAN asset management company. The product co-creation collaboration essentially combines Touch ‘n Go eWallet’s expertise in technology and ecosystems and Principal’s core expertise in investment strategy and fund management.

“I have always believed that the relationship between traditional financial services providers and Fintech’s will be one of increased collaboration, rather than just pure competition; and this is an example of that. The winners at the end of the day will be consumers, who will now have simpler access to higher value offerings,” said Effendy.

Touch ‘n Go eWallet is the first eWallet provider to obtain approval to operate as a Recognised Market Operator by the Securities Commission of Malaysia. The approval enables the company to directly distribute capital market products, including money market unit trust funds, through the Touch ‘n Go eWallet platform, without having to be directed to a third-party application.

Sharing her sentiments on GO+, Munirah Khairuddin, CEO of Principal Asset Management said, “At Principal, everything we do is anchored around our purpose of fostering a world where financial security is accessible to all Malaysians. We are committed to helping Malaysians achieve financial security in any given economic climate. All Malaysians irrespective of their financial background can now start to invest and inculcate the habit of investing, saving, whilst spending.

“Our new Principal e-Cash Fund was developed specifically for GO+ and focusses on convenience and yield enhancement. With as little as RM10, customers will be able to invest and earn daily returns in their eWallet investment account. This is just the beginning of our digital offering, and we look forward to developing many more,” she added.

GO+ is available effective 29 March 2021 to Touch ‘n Go eWallet users who are Malaysian citizens above 18 years old. Look out for the GO+ logo on the eWallet app, follow a few simple steps, do an initial minimum RM10 cash-in and start earning returns on your GO+ balance.

For more information and updates about GO+, visit www.tngdigital.com.my