Bridgestone Ecopia H/L 001 SUV Tyre Launched In Malaysia

The successor to the Bridgestone EP850 lands locally in sizes from 15- to 18-inches.

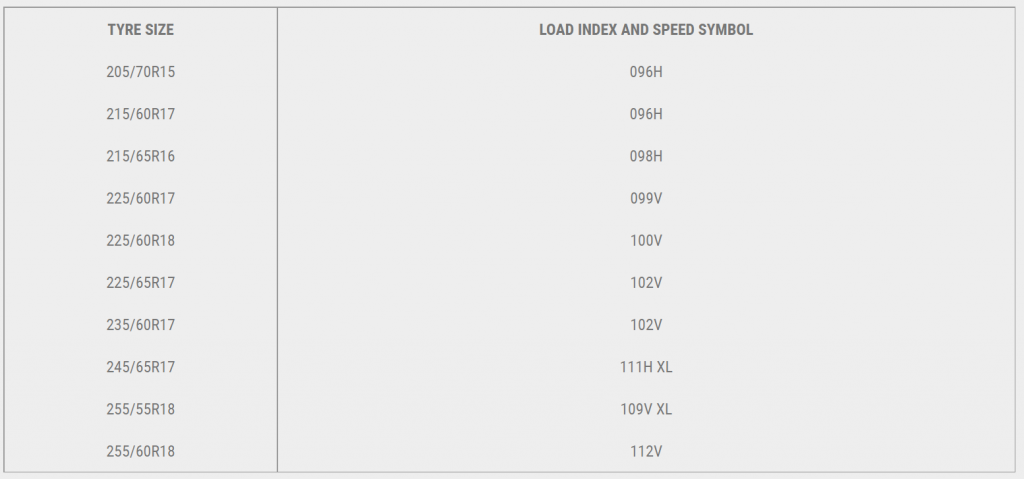

Bridgestone Malaysia has recently introduced its new Ecopia H/L 001 SUV tyre locally. A successor to the EP850 that came before, this latest offering by Bridgestone is available over here in sizes from 15- to 18-inches, and will cost from RM 284 to RM 854 per piece.

Developed by the Japanese tyre maker using its latest NanoPro-Tech rubber compound, the Ecopia H/L 001 is touted to offer a lower rolling resistance than what came before. Hence enabling for enhanced fuel efficiency and lower CO2 emissions, thereby further improving one’s vehicular environmental footprint.

These new Ecopia H/L 001 tyres also feature an improved chamfering sipe and rounded rib edge, which claims to improve braking performance, especially in the wet. A redesigned thread pattern and an optimised contact patch meanwhile should yield handling performance improvements, as well as an even wear pattern.

Speaking of wear however, the new Ecopia H/L 001 should also last longer, courtesy of deeper lug depths on its shoulders that are designed to strengthen the tyre’s stiffness and increase wear resistance. These new Bridgestones are claimed to offer a superior ride comfort and low road noise too, thanks to its new reinforced sidewalls.

“Ecopia H/L 001 is a low rolling resistance tyre designed for SUVs without compromising on safety or comfort,” commented Michael Chung, Managing Director of Bridgestone Tyre Sales (Malaysia) Sdn. Bhd. “Through our market feedback, key attributes of SUV drivers’ when evaluating tyres are grip, wet performance, wear life and comfort. Ecopia H/L 001 is a tyre that excels in all these fields with the added bonus of fuel savings.”

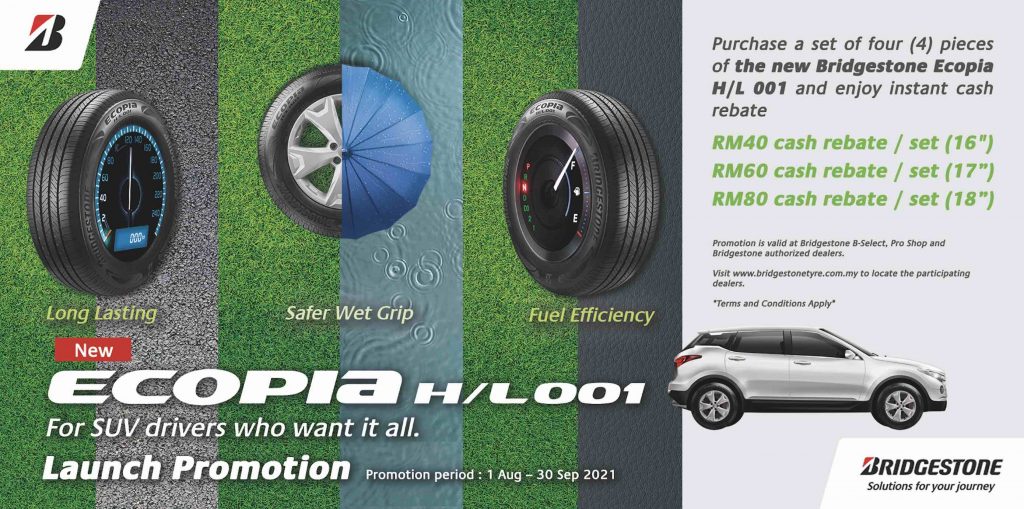

The Ecopia H/L 001 is currently available for purchase at Bridgestone B-Select, Pro Shop and other authorised Bridgestone tyre dealerships nationwide. There is also an ongoing launch promotion too till the 30th of September for these tyres, with every set of four purchased being entitled to an instant cash rebate of RM 40 to RM 80, dependent on tyre size.

PRESS RELEASE: Bridgestone is proud to introduce its new ECOPIA H/L 001 tyres, specifically designed for SUV drivers who desire a balance between safety, long wear life and fuel efficiency. This new generation eco-tyre reflects the craftsmanship of Bridgestone, the expert with over 20 years’ experience in developing high performing eco-tyres customized to demanding drivers who “want it all”.

Developed using Bridgestone’s advanced technologies and compounds, ECOPIA H/L 001 builds on the success of EP850 to provide confidence-inspiring wet handling and braking performance, an optimized contact patch that results in long lasting tread life, and rolling resistance to enhance fuel efficiency and cost savings. The tyres also provide SUVs with a smooth and comfortable ride experience.

“ECOPIA H/L 001 is a low rolling resistance tyre designed for SUVs without compromising on safety or comfort,” commented Michael Chung, Managing Director of Bridgestone Tyre Sales (Malaysia) Sdn. Bhd. “Through our market feedback, key attributes of SUV drivers’ when evaluating tyres are grip, wet performance, wear life and comfort. ECOPIA H/L 001 is a tyre that excels in all these fields with the added bonus of fuel savings.”

Safer Wet Grip

ECOPIA H/L 001 is designed with improved chamfered design that provides enhanced wet grip due to a flat contact point that grips wet road surfaces with higher frictional force.

In addition, the new tread pattern contributes to anti-hydroplaning performance with better handling.

Long Lasting

Deeper lug depth on the tyre shoulder is designed to strengthen stiffness in the tyre and increase wear resistance. ECOPIA H/L 001 features a new tread designed to prevent tyre deformation and provide long wear life.

Fuel Efficiency

ECOPIA H/L 001 features enhanced NanoPro-Tech that offers low rolling resistance contributing to daily fuel savings and less CO2 emissions, reducing the vehicle’s environmental footprint.