Nissan’s ‘The Arc’ Business Plan Aims To Return It To Greatness

The arc of Nissan’s trajectory towards greatness will involve a whole lot of new cars through to 2030.

Embroiled in a series of setbacks that culminated in their former head-honcho fleeing Japan in a packing case, likely even Nissan themselves will admit that the late 2010s were a bit of a write-off for the company. Fortunately however, the Japanese automaker has indeed been on a slow march back towards actually being halfway decent again.

Nissan has after all been hard at work refreshing its aging lineup, filling it with attractive new iterations of its most popular models like the X-Trail and Serena. The automaker has also debuted some sporty stuff (like the Z), as well as churned out some rather neat EVs (like the Ariya and Sakura) in the recent past too. And while none of them actually made it over here to Malaysia, the company as a whole has been nevertheless somewhat rejuvenated from its doom and gloom days that began about a decade ago.

It is therefore with this rejuvenated vigour too that Nissan has recently announced an ambitious new business plan to take it forward into the future. Dubbed by the automaker themselves as ‘The Arc’, this particular plan is said to focus on ‘a broad-based product offensive, increased electrification, new approaches to engineering and manufacturing, the adoption of new technologies, and the use of strategic partnerships to increase global unit sales and improve profitability.’

According to Nissan, ‘The Arc’ is positioned as a bridge between the Nissan NEXT business transformation plan running from fiscal 2020 through fiscal 2023 and Nissan Ambition 2030, the company’s long-term vision. This new plan is split into mid-term imperatives for fiscal years 2024 through 2026, and mid-long-term actions to be carried out through 2030.

Nissan President and Chief Executive Officer Makoto Uchida said: “The Arc plan shows our path to the future. It illustrates our continuous progression and ability to navigate changing market conditions. This plan will enable us to go further and faster in driving value and competitiveness. Faced with extreme market volatility, Nissan is taking decisive actions guided by the new plan to ensure sustainable growth and profitability. ”

Under this two-part plan, Nissan will first take actions to ensure volume growth through a tailored regional strategy and prepare for an accelerated transition to EVs, supported by a balanced electrified/ICE product portfolio, volume growth in major markets and financial discipline. Through these initiatives Nissan aims to lift annual sales by 1 million units and increase its operating profit margin to more than 6%, both by the end of fiscal year 2026.

This will then pave the way for the second part of the plan aimed to enable the EV transition and realize long-term profitable growth, supported by smart partnerships, enhanced EV competitiveness, differentiated innovations and new revenue streams. By fiscal year 2030, Nissan sees a revenue potential of 2.5 trillion yen from new business opportunities.

Balanced Product Portfolio, With 30 New Launches In The Next 3 Years

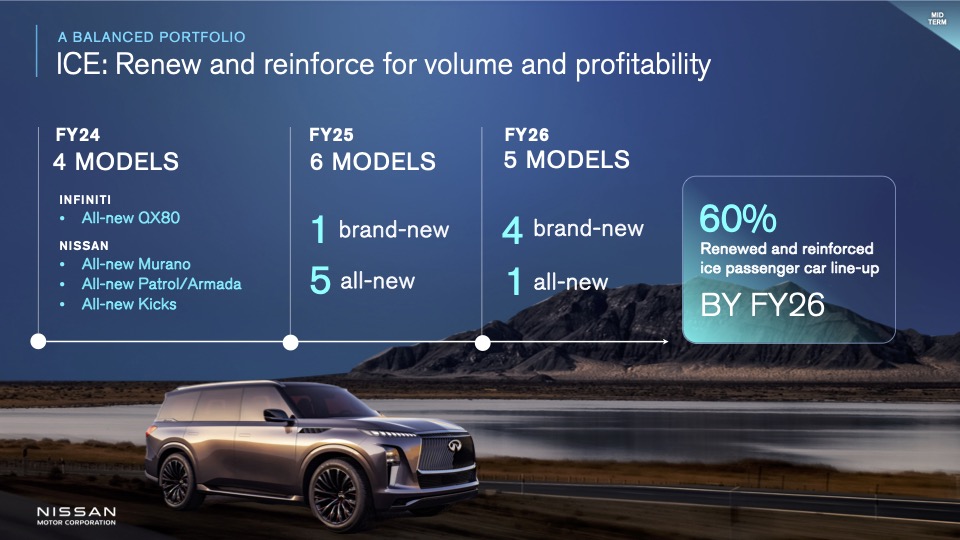

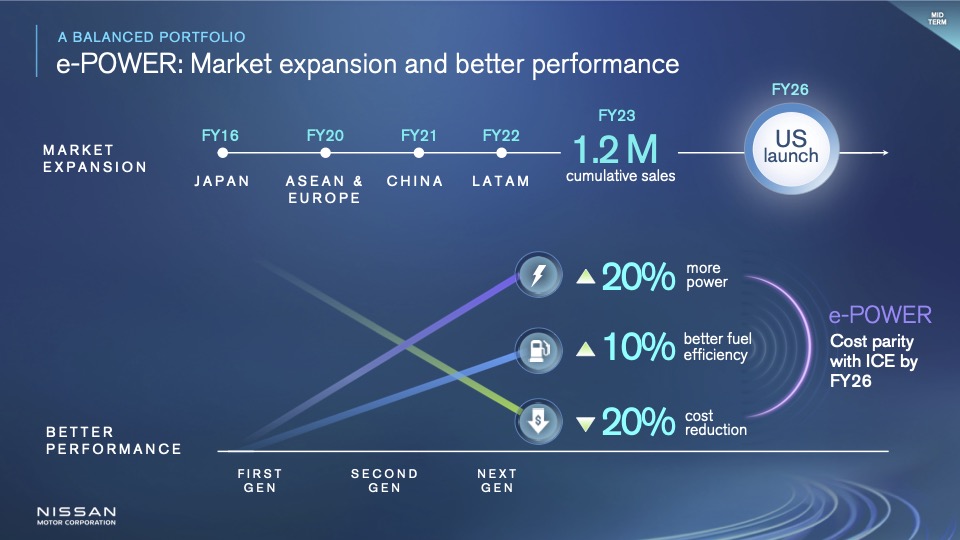

Under this new business plan, Nissan (including its luxury arm Infiniti) has the ambitious plan to launch some 30 new models over the next three years, of which 16 will be electrified, and 14 will be ICE models, to meet the diversified customer needs in markets where the pace of electrification differs.

Nissan plans to launch a total of 34 electrified models from fiscal year 2024 and 2030 to cover all segments, with the model mix of electrified vehicles expected to account for 40% globally by fiscal year 2026 and rise to 60% by the end of the decade.

Ensuring Market Growth Through A Tailored Regional Strategy, With Big Plans For China and America

And while on the topic of rising, Japanese automaker currently is bullish regarding its prospects of growth internationally. In facilitating this ambitious target, Nissan’s actions by fiscal year 2026 (unless otherwise indicated) in its key regions and markets:

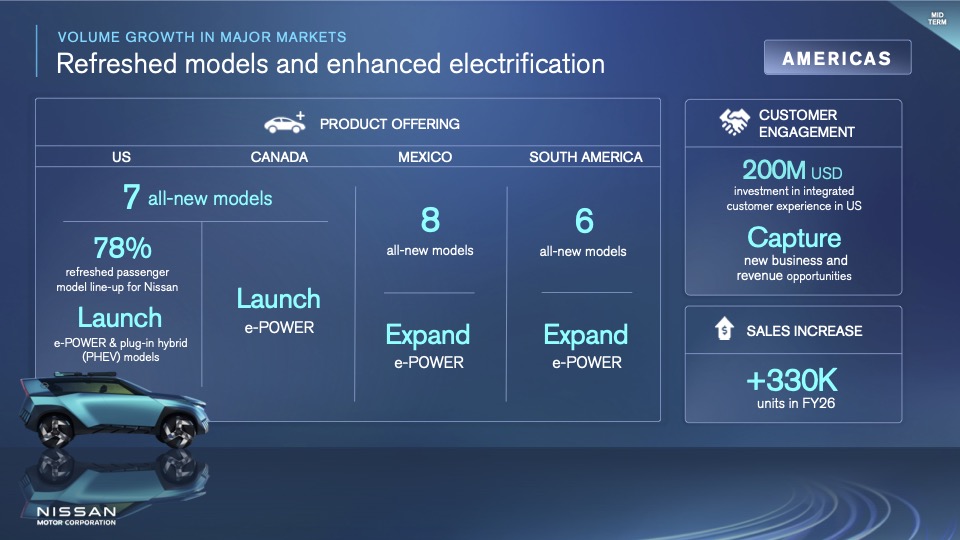

Americas:

- Increase across-region sales by 330,000 units (in fiscal year 2026 and compared to fiscal year 2023) and invest 200 million USD in integrated customer experience in the U.S.

- In the U.S. and Canada: Launch seven all-new models

- In the U.S.: Refresh 78% of passenger vehicle line-up for Nissan brand and launch e-POWER and plug-in hybrid models

China:

- Refresh 73% of Nissan-brand models and launch eight new-energy vehicles (NEVs), including four Nissan-branded models

- Target 1-million-unit sales in fiscal year 2026, representing an increase of 200,000 units

- Start vehicle exports in 2025; Aim for 100,000 unit level

- Continue to optimise production capacity with local partners

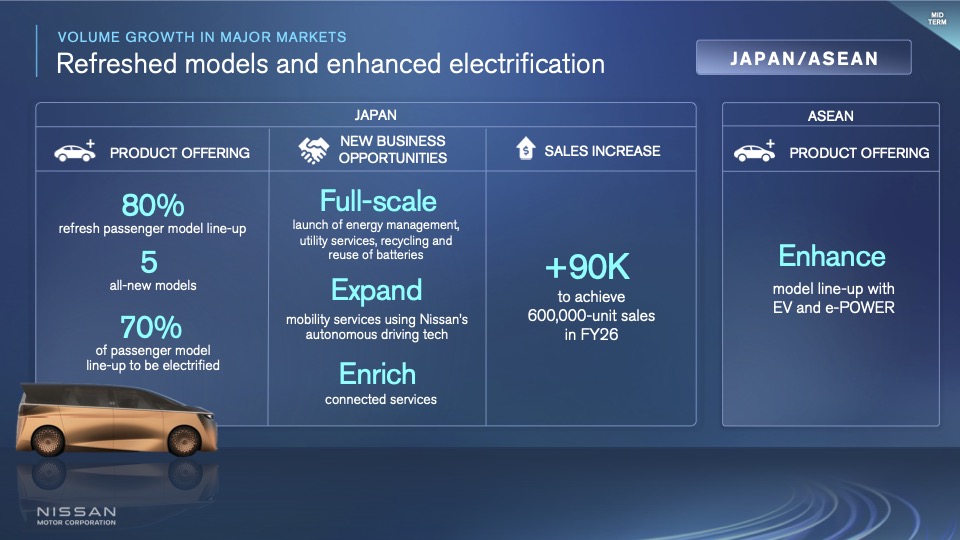

Japan:

- Refresh 80% of passenger model line-up, launching five all-new models

- Achieve a 70% electrified level in passenger vehicle line-up

- Increase sales by 90,000 units (compared to fiscal year 2023) to 600,000 units in fiscal year 2026

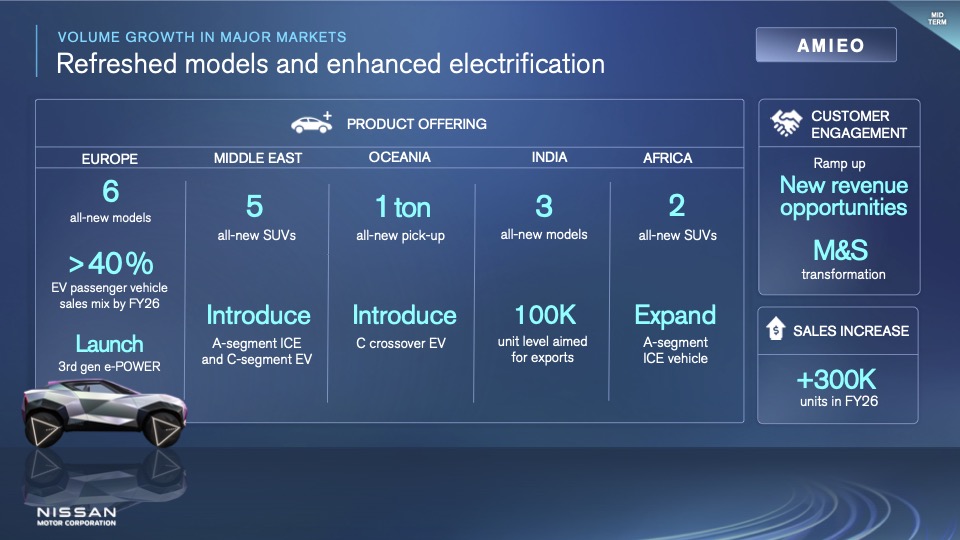

Africa, Middle East, India, Europe and Oceania:

- Increase across-region sales units by 300,000 units (in fiscal year 2026 an compared to fiscal year 2023)

- In Europe: Launch six all-new models; achieve 40% EV passenger-vehicle sales mix

- In the Middle East: Launch five all-new SUVs

- In India: Launch three all-new models and become a hub for exports, at a level of 100,000 units

- In Oceania: Launch a 1-ton pickup and introduce a C crossover EV

- In Africa: Launch two all-new SUVs and expand A-segment ICE vehicle

EV Competitiveness, With Cost-Parity Goals Between EV and ICE by 2030

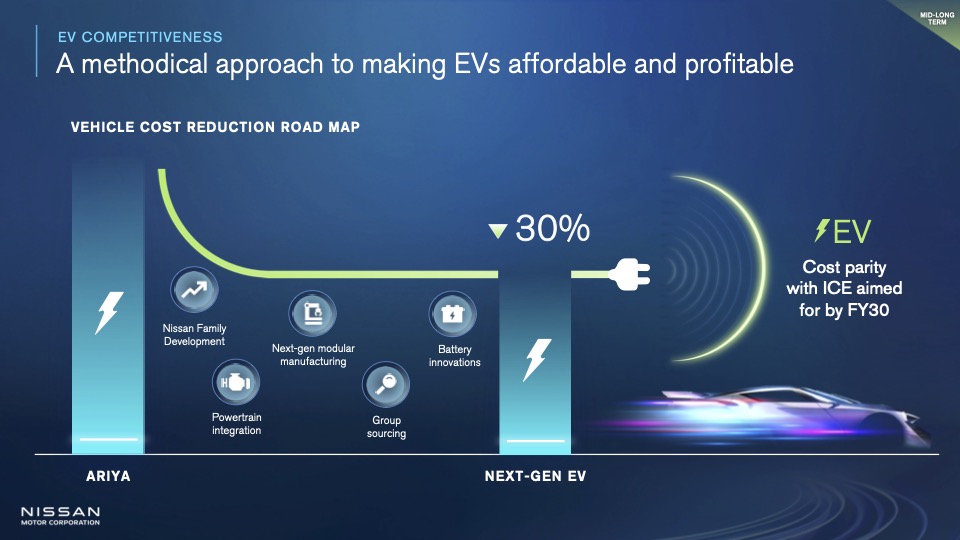

The product offensive will be supported by new development and manufacturing approaches aimed to make EVs more affordable and increase profitability. By developing EVs in families, integrating powertrains, utilising next-generation modular manufacturing, group sourcing, and battery innovations, Nissan aims to reduce the cost of next-generation EVs by 30% (when compared to the current model Ariya) and achieve cost-parity between EVs and ICE models by fiscal year 2030.

In the area of family development alone, the cost of subsequent vehicles – those developed based on the main vehicle in the family – can be reduced by 50%, the variation of trim parts reduced by 70% and development lead time shortened by four months. By adopting modular manufacturing, the vehicle production line will be shortened, reducing the production time per vehicle by 20%.

Under the Arc plan, more plants in Japan and overseas will adopt the Nissan Intelligent Factory concept, with the Oppama and Nissan Motor Kyushu plants in Japan, the Sunderland Plant in the UK and Canton and Smyrna plants in the U.S. starting the adoption from fiscal year 2026 through 2030. Meanwhile the EV36Zero production approach will be extended from Sunderland in the UK to plants including Canton, Decherd and Smyrna in the U.S., and Tochigi and Kyushu in Japan from fiscal year 2025 through 2028.

New Technologies, With Autonomous Driving And Solid State Battery Development Aims

The plan includes proposals to accelerate the evolution of vehicle intelligence technologies such as next-generation ProPILOT driver-assistance system, which realise door-to-door autonomous driving technology from on-highway to off-highway, private premises, and parking.

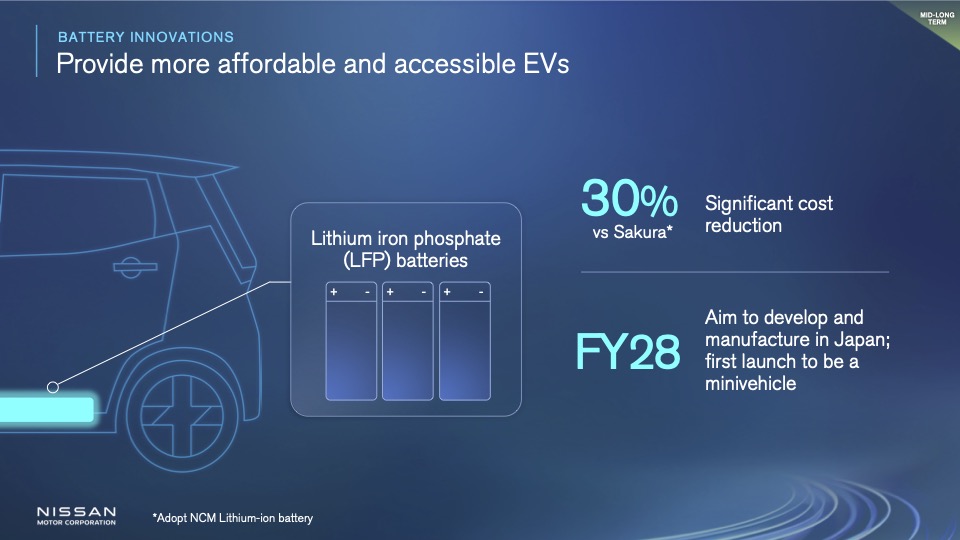

Nissan will offer enhanced NCM li-ion, LFP and all solid-state batteries to provide diversified EVs to meet different customer needs. Nissan will significantly enhance NCM li-ion batteries, reducing quick-charging time by 50% and increasing energy density by 50% compared to the Ariya. LFP batteries, to be developed and produced in Japan, will be launched that will reduce cost by 30% compared to the Sakura EV minivehicle. New EVs with enhanced NCM li-ion, LFP and all-solid-state batteries will be launched in fiscal year 2028.

Strategic Partnerships

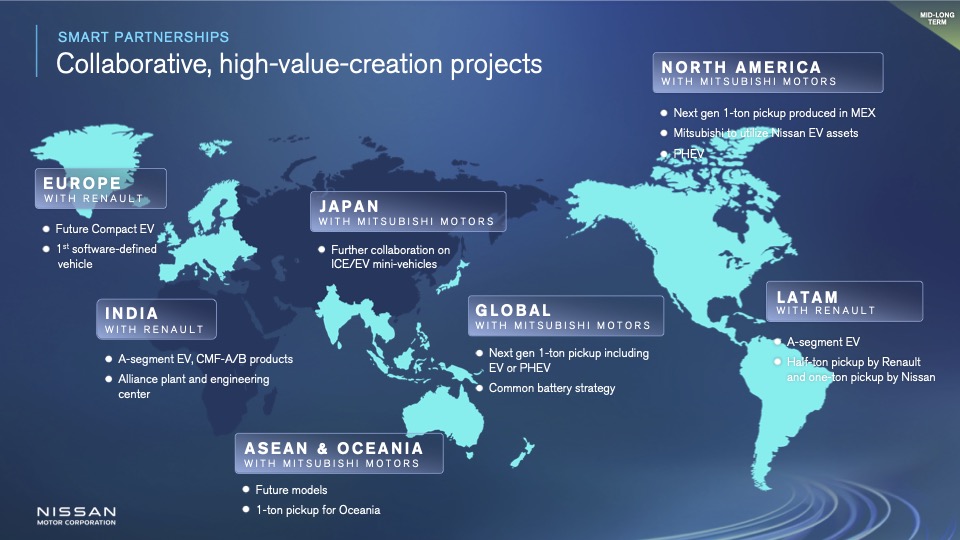

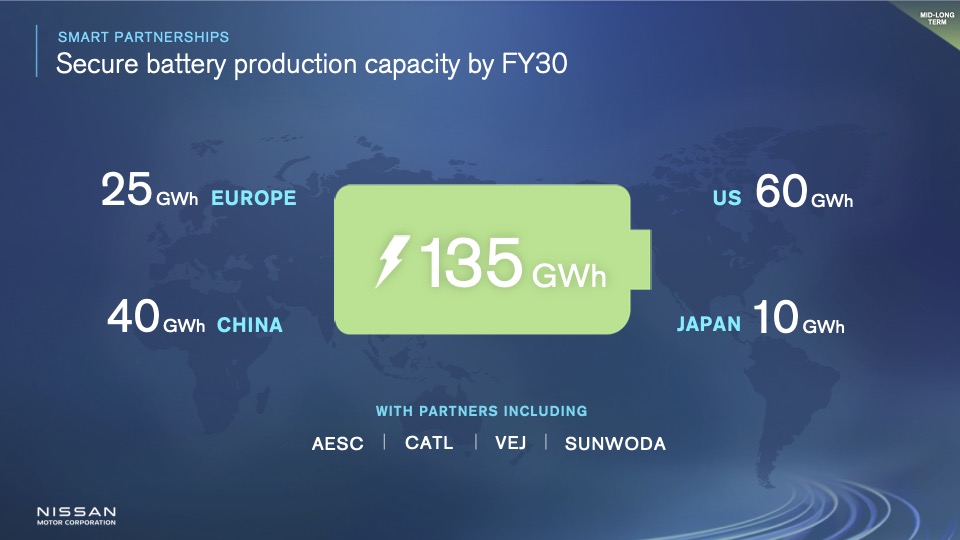

Nissan will harness strategic partnerships to stay competitive and offer a global portfolio of products and technology. Nissan will continue to leverage the alliance with Renault and Mitsubishi Motors in Europe, LATAM, ASEAN and India. In China, Nissan will fully utilise its local assets to meet the needs of China and beyond; and explore new partnerships in Japan (like the teased EV tie-up with Honda) and the U.S. Batteries will be developed and sourced with partners to bring 135 gigawatt hours of global capacity.

Financial Discipline To Deliver Resilient, Profitable Performance

According now to Nissan, underpinning ‘The Arc’ is firm financial discipline, enabling stable CAPEX and R&D investment ratio versus net revenue of between 7% to 8% excluding battery capacity investment. Additionally, Nissan plans to invest more than 400 billion yen in battery capacity. Meanwhile, investment in electrification will increase progressively, becoming more than 70% by fiscal year 2026.

Managing these investments is aimed to allow delivering benefits to all stakeholders, with Nissan maintaining positive free cash flow before M&A – even after electrification investments. This is to secure total shareholder return at more than 30%. Nissan aims to maintain net cash at a healthy level of 1 trillion yen throughout the Arc plan period.

“Under this comprehensive plan we will enhance Nissan’s competitiveness and achieve sustainable profitability,” added Uchida. “Nissan is confident that it has what it takes to properly execute this plan, which will provide us with the firm foundation we need to bridge to our Nissan Ambition 2030 vision.”