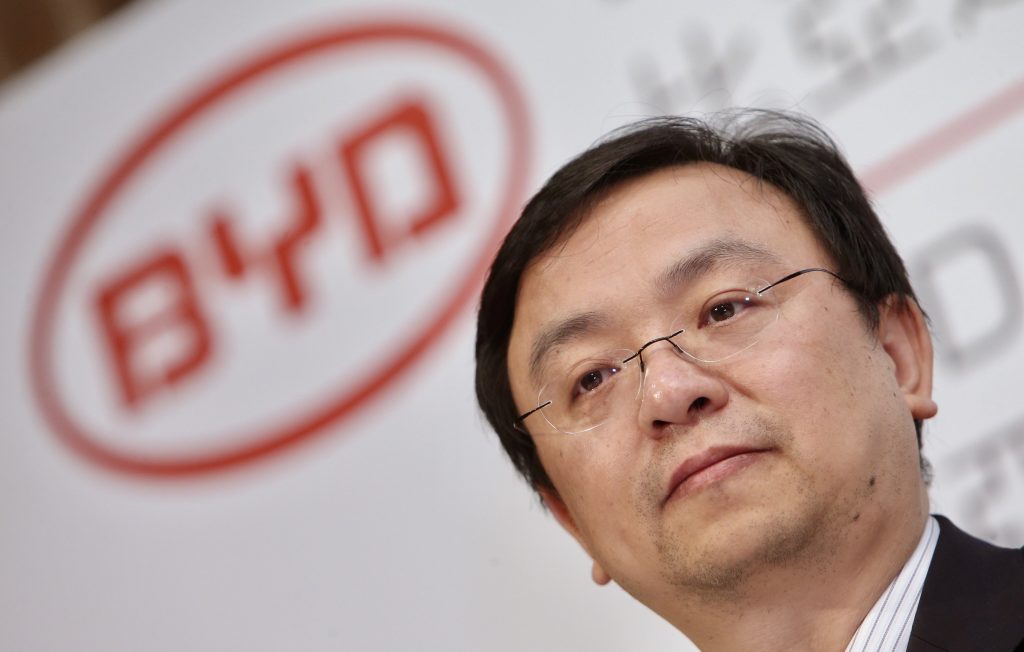

Meet Wang Chuanfu, The Man That Is ‘Building Everyone’s Dreams’

Meet the former professor turned billionaire entrepreneur that is beating Tesla at its own game.

At the present moment at least, the one name many probably associate with proliferating the rise of EVs will probably be Elon Musk. And while that honour is certainly not undeserved, there might be one more name that more should take note of in the upcoming inevitable all-electric era — Wang Chuanfu.

Such is simply because while preferring to maintain a low profile, this former professor had recently helmed his company to take Tesla’s crown as the biggest producer of battery-powered cars. And if the current continued projected sales trend are to come true too, there is no doubt that Mr. Wang is on the path to building more and more people’s dreams of one day owning their very EV.

Now of course just for those who are still unclear of who exactly is Wang Chuanfu, he is both the co-founder and current CEO and chairman of BYD. A company which not only has recently dethroned Tesla as the world’s best-selling EV manufacturer in 2023, but is also incidentally the world’s second largest maker of batteries behind CATL.

Born in 1966 in east China’s agricultural Anhui province, Chuanfu was raised by his older siblings after his parents, both rice farmers, had sadly passed. He then studied chemistry at the Central South University and obtained a master’s degree from the Beijing Non-Ferrous Research Institute that led him to work as a government researcher before founding BYD in the 90s.

It is worth highlighting here however that when the then 29-year-old Chuanfu decided to move south to Shenzhen to set up BYD with his cousin Lu Xiangyang, cars weren’t even in the picture then, as BYD was instead initially a mobile phone battery manufacturing company.

Though while the product it made back then was different, the business strategy of BYD remains the same to this day: emulate successful products and keep costs as low as possible. The goal back then with their phone battery business was to replicate products made by the likes of Sanyo and Sony, but make them far cheaper than their Japanese suppliers. And what do you know, the strategy worked and by 2002, BYD had dominated the rechargeable battery market.

It was then in the following year of 2003 that BYD first dipped its toes into the auto manufacturing sector, as Chuanfu had decided to purchase failing state car manufacturer Tsinchuan Automobile to become BYD Auto. Using the same low-cost mantra as its phone battery business, the far cheaper Toyota Corolla copy that BYD launched as the F3 in 2005 was soon topping the sales chart in China by the end of the decade.

BYD’s stratospheric rise in this current EV era today adds further glory to the rags-to-riches legend of Wang. The Financial Times reports for the story of this former professor in nonferrous metals research turned hard-headed executive with a fastidious focus on technology, supply chains and cost-cutting have since become gospel in Chinese science and business schools.

To his employees on the other hand, Wang is simply known as “The Chairman”. Both revered and feared, the 57-year-old billionaire’s unassuming demeanour belies a micromanager with a Stakhanovite work ethic.

In 2008, Charlie Munger convinced his business partner, a certain Warren Buffett, to invest $230 million (RM 1.07 billion) for a 10% stake in the then little-known Chinese company, arguing that in Wang they had a mix of Thomas Edison and Jack Welch, the former General Electric chief. Berkshire has since sold a 2% stake in the BYD for $890 million (RM 4.1 billion), while its remaining holding is worth about $2.3 billion (RM 10.68 billion).

Though while Munger was impressed with Wang’s engineering skills, experts instead largely attribute BYD’s success to its ruthless culture of cost-cutting and steadfast vertical integration. The Chinese juggernaut has the steadfast belief that contracting other companies for hardware or services is a last resort, to the point that a BYD executive once told car reviewers the company made everything on the vehicle “except the tyres and the windscreen”.

And while many may have bet the house for BYD’s pursuit of purely in-house manufacturing will be the root cause in its downfall, it has instead resulted in several manufacturing innovations that its competitors are now forced to buy into. In one example, in BYD’s early days, Wang acquired a panel-stamping tool from Jeep in Beijing, and this had in turn lead to the company cracking the “cell-to-body” technology, which sandwiches together the EV battery cell with a car body.

Now touching upon briefly as to why BYD entered the EV space, Wang had previously told CNBC in an interview his ambition to start an all-electric car company was because “petrol was set to create an (environmental) problem, we needed to start developing electric cars. The future of electric cars in China is very bright”.

And in an era when China’s ruling Communist party frequently cracks down on the nation’s business elite, experts believe that Wang, a proponent of high-tech products that help achieve Beijing’s carbon emission reduction goals, is on relatively safe ground. In fact, Chinese President Xi Jinping has gave a rare endorsement to the BYD CEO in his annual new year address last year by noting that Chinese-made New Energy Vehicles showcased “China’s manufacturing prowess”.

Turning back towards the business of Tesla vs BYD for a bit too, while BYD’s battery-only vehicles have finally trumped Tesla in the fourth quarter of 2023, taking into account plug-in hybrid vehicles however, the Chinese automaker would have overtook its American counterpart in the first half of 2022.

BYD’s total sales for 2023 were up 62% to more than 3 million vehicles, compared with 1.81 million for Tesla. And in a bout of delicious irony for Mr. Musk — who had incidentally previously dismissed that Tesla will ever be challenged by BYD back in 2011 — it was the American entrepreneur’s own decision in late 2022 to chase higher volume in China through price cuts that gave its Chinese rival that recent boost in sales to overtake it.

Looking to the future of BYD meanwhile, the Chinese juggernaut’s next sights are on further foreign expansion. In November last year, upper management at the company were signalling that they are currently for a market share of about 10% in overseas markets, excluding the US or Europe in the long term. This implies annual overseas sales — outside of two crucial western markets — of 2-3 million cars, which is a huge jump up from about 240,000 units it exported in 2023. A big test regarding this aspect on the horizon for BYD would be the company’s plans to build its first European car factory in Hungary.

Though in all blatant honestly, the Shenzhen-based electric-vehicle maker will likely be the next unassailable king of EVs for a long time coming. And there is perhaps no clearer case to be made for this than BYD’s mask-making prowess. Yes, while perhaps off topic slightly, BYD is reportedly also to be the world’s largest manufacturer of face masks, churning out about five million a day.

A project that Mr. Wang started right when the Covid-19 pandemic hit, the enterprising CEO had managed to build mask making machines in just 7 days (with the help of 3,000 of his engineers) He had also managed to whip up a task force to design and build new production lines to manufacture hand sanitisers to the tune of 300,000 bottles daily.