Computer Chips From Malaysia Raking In High Profits

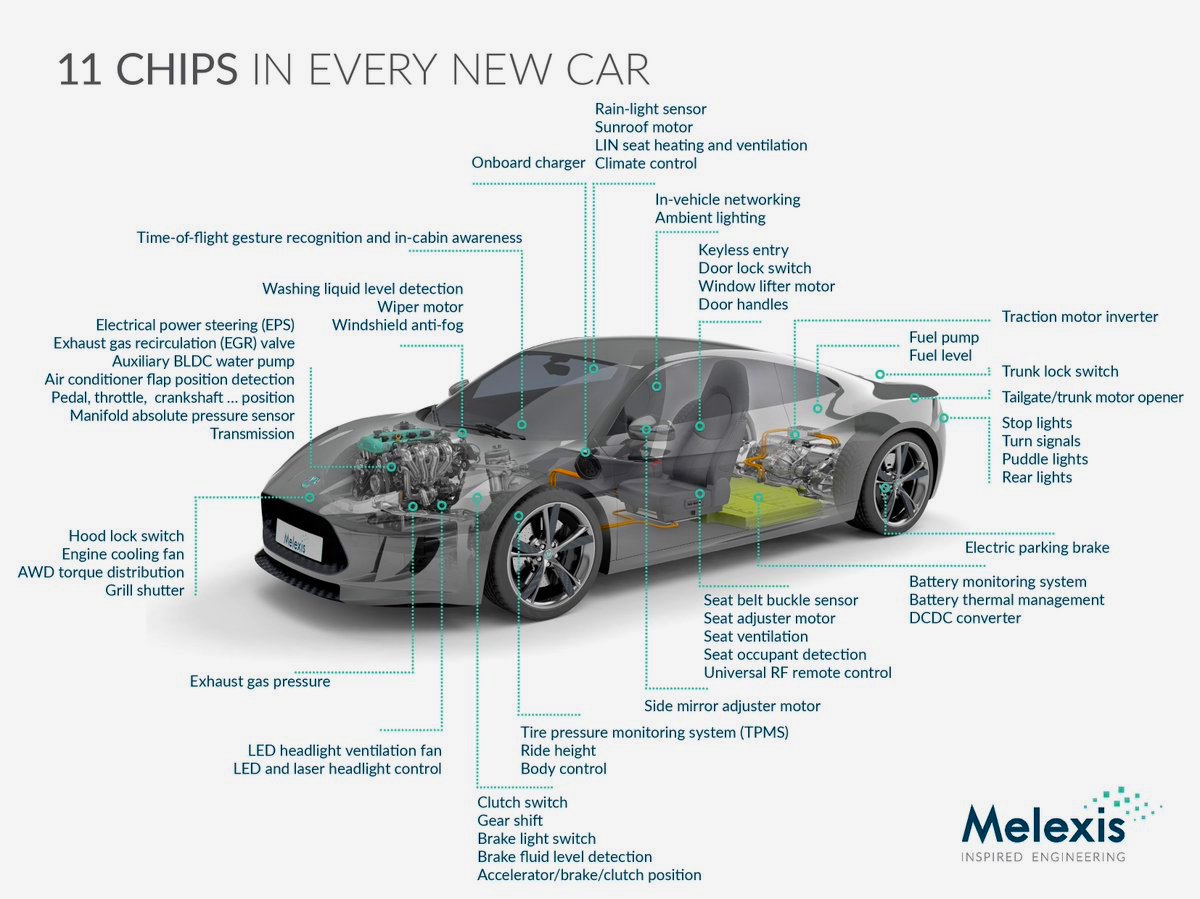

Many car manufacturers around the world and also in ASEAN are still facing a continues computer chips shortage and this is forcing some of them to pay higher prices to manufacturers and even buy in advance to secure consistent supply.

Reuters has just reported that Malaysia’s electronics company Unisem, a supplier of basic computer chips that drive the world’s cars, smartphones and home devices, has opened doors for renowned customers to lock take-or-pay long-term orders.

Manufacturers are rushing to replenish their depleted computer chips inventories during the suppression of the coronavirus pandemic, especially automakers who previously canceled their orders in anticipation of low demand.

The computer chips shortage forced a reduction in production and is still disrupting the supply chain, just as consumer demand increases with the global relaxation of COVID restrictions in everyday life.

In January this year, Taiwan’s biggest chip manufacturers were working to assist German auto manufacturers get their factories moving to fulfil back orders.

Malaysian chip packaging company Unisem are leading buyers for drives to sell computer chips to manufacturers of automobiles and electronics, demanding as many assembled chips as the factory can produce. At any cost.

However, Malaysia’s computer chips assembly industry, which accounts for more than one-tenth of world trade of more than USD20 billion, is also in short supply (while high-end semiconductors are favoured, it is exacerbated by years of underinvestment in basic chip production.

Companies need to increase production to avoid COVID-19 infections in factories that can cause a complete shutdown.

“The shortage is very real,” said Unisem Chairman John Chia. “The (client’s) CEO escalating the problem directly to me shows that this is a serious problem, now they want to talk to me directly,” he told Reuters.

Chia refused to provide the name of the client requesting as much supply as possible. Unisem’s customers include suppliers to global automakers and electronics companies such as Apple who recently reported that chips shortages was reducing output for the iPhone 13.

He said China’s Chengdu plant will be booked throughout next year due to so strong demand that it will take months to close backlogs for some auto parts.

According to market research firm Yole Development, the pre-pandemic global outsourced chip assembly and testing industry is estimated to be worth about USD23 billion and will grow to USD30 billion by 2022.

Taiwan is the largest service provider with more than 50 percent of the market share, followed by China, the United States and Malaysia. The latter includes suppliers and factories servicing chip makers such as STMicroelectronics and Infineon, as well as automakers such as Toyota Motor Corp, Ford Motor Co and General Motors.

Wong Shu Hai, chairman of the Malaysian Semiconductor Industry Association, warns that the shortage is likely to continue for years.

According to Wong, some customers are ordering more supplies than they need, but long-term contracts of one to three years are now the norm in the new industry.

“It will take at least two to three years to meet demand,” Wong told Reuters.