Here Are The Revised EV Road Tax Rates For 2026 Onwards

This newly-revised structure sees for current EV road tax rates to start from as low as RM 40.

After what seemed like months of silence on this front – the Ministry of Transport has nevertheless finally revealed the revised road tax rates for EVs. And without beating around the bush here, the table below breaks down how much road tax EV owners will be paying for their zero-emissions rides every year from 2026 onwards.

| EV Group | Min Output (W) | Max Output (W) | Increment / 9,999 W Block (RM) | Min Road Tax / Year (RM) | Max Road Tax / Year (RM) |

| A | 1 | 100,000 | 10 | 20 | 70 |

| B | 100,001 | 210,000 | 20 | 80 | 280 |

| C | 210,001 | 310,000 | 30 | 305 | 575 |

| D | 310,001 | 410,000 | 50 | 615 | 1,065 |

| E | 410,001 | 510,000 | 100 | 1,140 | 2,040 |

| F | 510,001 | 610,000 | 150 | 2,165 | 3,515 |

| G | 610,001 | 710,000 | 200 | 3,690 | 5,490 |

| H | 710,001 | 810,000 | 250 | 5,715 | 7,965 |

| I | 810,001 | 910,000 | 300 | 8,240 | 10,940 |

| J | 910,001 | 1,010,000 | 350 | 11,265 | 14,415 |

| K | > 1,010,001 | N/A | 20,000 | ||

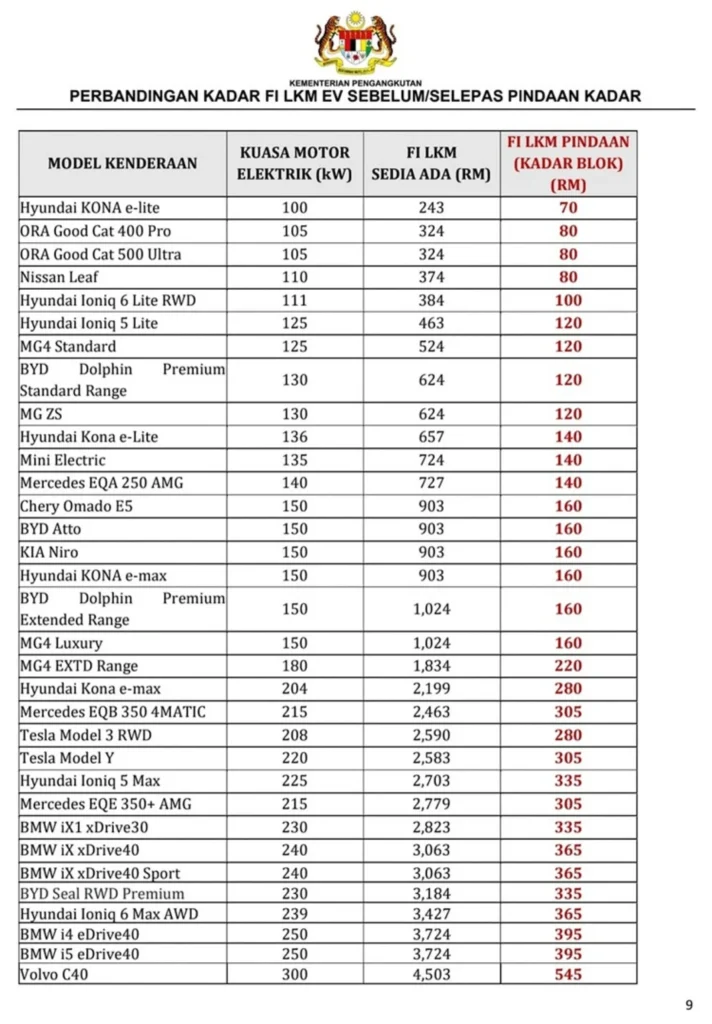

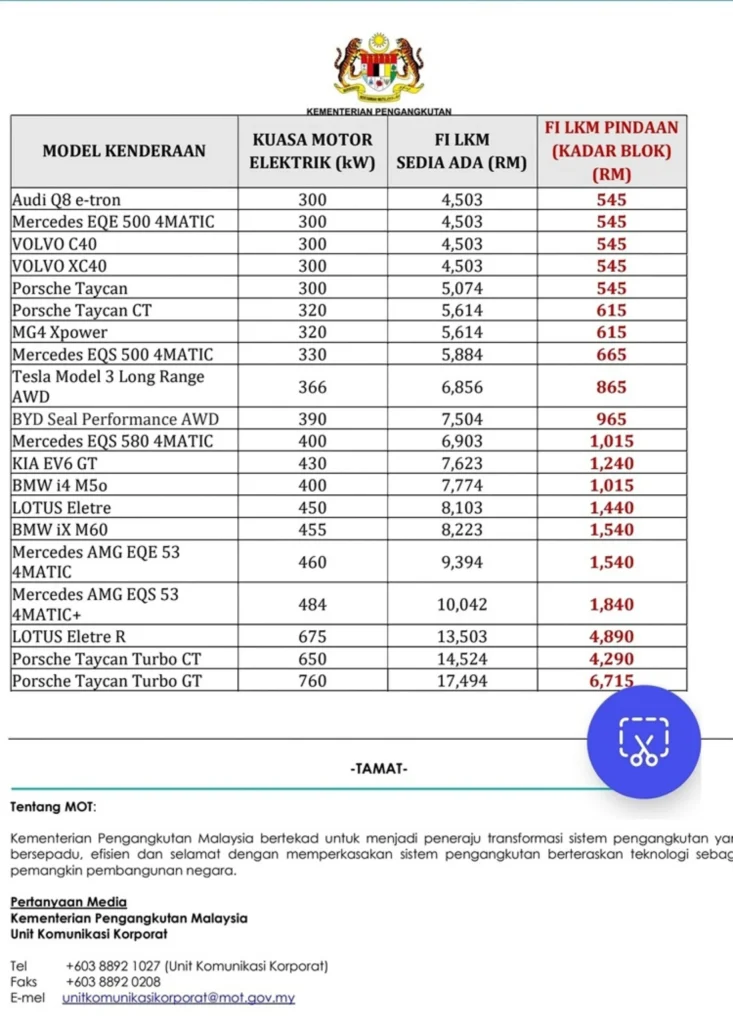

Now understandably, the above generalised rate table won’t really mean much to most people. So here instead is a corresponding list of how much the annual road tax will cost in 2026, for EVs that are currently on sale in Malaysia.

Just to discuss a little bit more regarding this newly-revised road tax rates for EVs here, it is worth highlighting that unlike the existing ICE taxation structure, there is currently to be no difference in road tax for EVs registered between East and Peninsula Malaysia. The rates will also be the same regardless of body types for EVs, as well as for individual and business registrations until further notice.

Going from the table too now, it is clear to see that the rates for EVs are to now be significantly lower than the (ludicrously high) taxation structure that was in place previously. A Mercedes-Benz EQE 350+ for instance will only command a RM 305 annual road tax, instead of RM 2,779 following the old rate; while a BYD Atto 3 is to now only cost RM 160 annually to tax, relative to the RM 903 it was before.

It is also similarly obvious that EV road taxes are (for now at least) be significantly more affordable than their equivalent ICE-powered counterparts as well, for which the transport ministry aims will further encourage Malaysians to transition to these zero-emissions vehicles. Though trying hard not to be a cynic here, it is really only the higher-powered (and typically higher-priced) EVs that are currently reaping the biggest rewards from this revised taxation structure.

Such is because the RM 160 road tax charge on a middle-of-the-road BYD Atto 3 is still to be higher than the RM 90 it costs to tax the 1.5-litre Honda HR-V or Proton X50. This is meanwhile contrasted against the fiery hot smart #1 BRABUS and speedy Swede Volvo C40 that only costs RM 615 and RM 545 in annual road tax respectively, which is less than what it costs to tax an ICE equivalent with a 2.5-litre engine displacement.

The transport ministry has nevertheless said that these rates will be revised at least every five years, in order to ensure effectiveness in achieving the transition objectives to EVs and the impact on government revenue. The transport ministry has also emphatically shut down any notion of adjusting the road tax fees for ICE vehicles, with Transport Minister Anthony Loke recently stating that the existing rates ‘are already low and reasonable’.